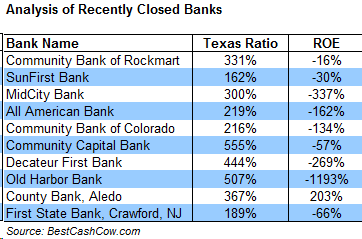

Are you banking at an institution that is danger of failing? How do you determine if your bank is in jeapordy and might be closed by the FDIC or another regulator? Most banks today do not fail in the traditional sense, instead they are seized by the FDIC or another bank regulator as their financial ratios deteriorate. At BestCashCow, we list several pieces of financial information for every FDIC insured institution. This includes the Texas Ratio of a bank, its Return on Equity and its Capitalization. To determine whether these can be predictive, we analyzed the Texas Ratios and the Return on Equity of the last ten bank failures. The chart below shows what we found:

As you can see, closed banks had several things in common:

- Texas ratios above 150%. A bank is considered to be under stress if its Texas Ratio exceeds 100%. The Texas ratios measures the capital and reserves a bank has to cover bad loans. A Texas Ratio above 100% means that the bank no long has enough to cover potential losses.

- Negative Return on Equity. Return on Equity measures the amount of income generated by the bank's equity. A negative return on equity is a sign that the bank is no longer profitable.

Of the last ten bank closures, every bank had a Texas Ratio greater than 150% and a negative Return on Equity.

Just because a bank's financials fit this state, does not necessarily mean it will close, but it is a strong warning sign. Be wary. FDIC insured banks provide some protection from bank failure ($250,000 per individual per bank) but there are other negative repurcussions. These include:

- A depositor may lose some or all of the money above FDIC limits if a bank fails.

- Any CD or CD IRA which a consumer holds in a failed bank may be reset once the bank’s assets are transferred to another bank or cashed out by the FDIC. For example, a depositor who holds a 5-year CD paying 6% APY from 2007 might find the CD called, resulting in lost interest.

- Failing banks may not have the time and money needed to provide top-notch customer service and support. They are fighting for their survival.

- The cost of bank failures is ultimately borne by the consumer. Money spent by the FDIC to insure bank deposits comes from a fee levied on all banks. The fee that a bank pays, is passed through to the consumer in the form of higher account fees, bank charges, and interest rates on loans. Ultimately, if the bank failure is big enough or systemic enough, the general public must come up with the funds to bail out the banks, as with the TARP and the S&L bailout in the 1980s.

It's worth it to spend a minute taking a look at your bank and understanding its financial condition.

Add your Comment

use your Google account

or use your BestCashCow account